The Indian aviation landscape is currently undergoing one of the most significant transformations in its recent history. With the imminent merger between Air India and Vistara, scheduled for March 2025, an important chapter in Indian aviation is coming to a close. This union between the historical national carrier and the young premium airline represents much more than a simple corporate restructuring – it's the meeting of two legacies, two philosophies, and two distinct approaches to the flying experience. For travelers, this merger raises numerous questions: what will become of Vistara's appreciated passenger experience? How will Air India integrate the standards established by its former competitor? What opportunities are opening up for Indian and international passengers?

With just months before this definitive integration, our analysis examines the concrete implications for the traveler experience and the challenges this new Indian giant will face in an ultra-competitive market.

The history of Air India and the Tata Group constitutes a fundamental chapter in Indian aviation. Founded in 1932 by J.R.D. Tata under the name Tata Airlines, the airline was nationalized in 1953, when it took the name Air India. During nearly seven decades under government control, the Indian national carrier experienced periods of glory in the 1960s-70s, before entering a long decline marked by chronic financial difficulties and a progressive deterioration in service quality.

The acquisition of Air India by Tata Sons in January 2022, for approximately $2.4 billion (including the assumption of part of the debt), symbolically represented a return to its roots. This privatization came after several unsuccessful attempts by the Indian government to revive an airline that was accumulating daily losses estimated at $3 million before the acquisition.

The pre-merger Air India passenger experience presented several distinctive characteristics:

Numerous testimonials reflect the challenges Air India faced: a tarnished reputation despite a rich heritage and a customer experience that had lost its former luster.

In striking contrast, Vistara entered the Indian skies in January 2015, the result of a partnership between Tata Sons (51%) and Singapore Airlines (49%). This project represented the Tata group's return to commercial aviation after six decades of absence, bringing a radically different vision to a market dominated by low-cost carriers and a struggling Air India.

From its inception, Vistara deliberately chose to position itself as a more premium alternative:

This differentiated approach quickly allowed Vistara to build a reputation for relative excellence in the Indian market. The cabins of domestic A321neos offered leather seats with generous spacing in Economy class (30-31 inches compared to 28-29 inches from some competitors), 40° reclinable seats in Premium Economy, and comfortable Business Class seats. The cabins of Vistara's aging A320s, however, offered less legroom.

The long-haul fleet, composed exclusively of Boeing 787-9 Dreamliners, offered some of the most modern cabins in the region, with Business Class seats arranged in a 1-2-1 configuration providing direct aisle access, and a genuine Premium Economy cabin – a rarity for an Indian airline.

What distinguished Vistara from Air India was a certain consistency in the passenger experience. Passengers often knew what to expect when booking a ticket with Vistara, and generally, these expectations would have been met. Vistara's premium ground service, the option to pre-order special meals, and responsive customer service completed this experience that aimed to be premium from end to end.

However, this premium positioning was not without challenges. The airline experienced difficulties in achieving profitability, operating at a loss during the majority of its independent existence. Punctuality issues also affected its reputation, particularly at congested airports like Mumbai. Nevertheless, on the eve of the merger, Vistara was generally considered to offer one of the best air travel experiences available in India.

Contrary to what one might think, the transformation of Air India did not wait for the effective merger with Vistara to begin. From the acquisition by the Tata group in 2022, an ambitious modernization program was launched, creating a period of coexistence between a "new Air India under construction" and Vistara.

This pre-merger transformation materialized through several major initiatives that directly impacted the passenger experience.

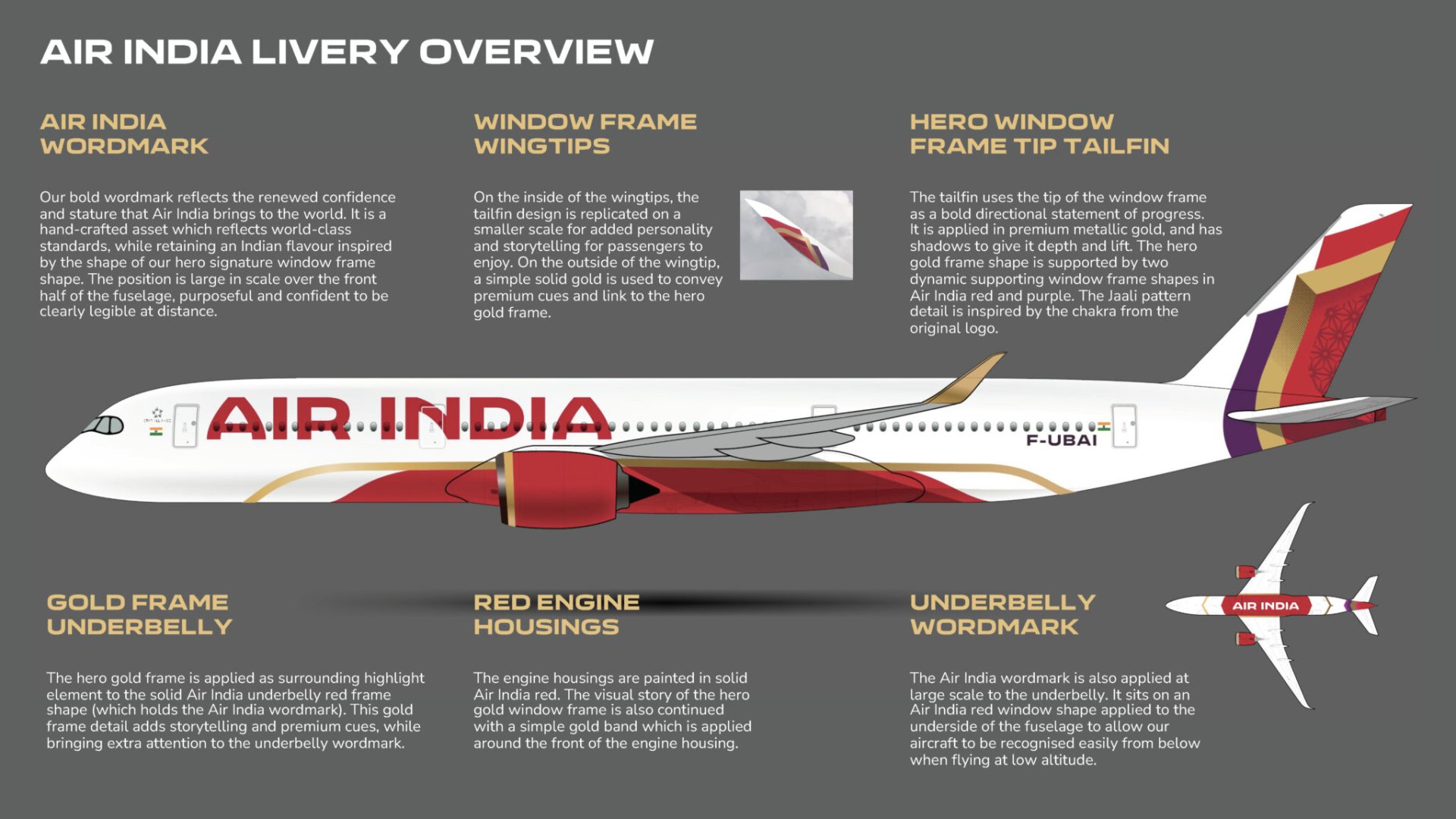

Air India unveiled a completely redesigned visual identity, abandoning the famous "Maharaja" as the central element in favor of a modernized interpretation of the "Jharokha" (traditional Indian architectural motif). This new identity combines traditional deep red with gold and purple tones, in a streamlined design that marks a break from the past while maintaining an Indian cultural anchor.

"The new logo and colors symbolize our ambition to create a world-class airline deeply rooted in Indian heritage, but resolutely forward-looking", stated Campbell Wilson, CEO of Air India.

This visual transformation has progressively been deployed across all customer touchpoints: new aircraft livery, redesigned crew uniforms, redesigned onboard documentation, and a complete overhaul of the digital environment (website and mobile application).

In February 2023, Air India made a major move by announcing a mega-order of 470 aircraft (250 Airbus and 220 Boeing), the largest in commercial aviation history.

The first A350-900s, delivered in late 2023, have become the technological showcase of the airline, with entirely new cabins branded "Vista". These aircraft, initially scheduled to be delivered to Aeroflot, maintained the cabin configuration and seats planned for the Russian flag carrier.

Business Class is equipped with 28 Collins Aerospace Horizon seats arranged in a 1-2-1 configuration. These mini-suites offer high privacy thanks to a sliding door, direct aisle access for each passenger, and are equipped with a 2-meter-long lie-flat seat, a 21-inch 4K screen, improved storage, and down duvets. This represents a significant improvement compared to the completely outdated Business Class equipping the airline's Boeing 777 and 787 fleet.

The Premium Economy on Air India's Airbus A350 is equipped with 24 Collins Aerospace MIQ seats in a 2-4-2 configuration. It features seats with 40° reclinable backrests with leg rests and generous spacing (96.5 cm).

Economy class features 264 seats in a 3-3-3 configuration, equipped with 13.3-inch individual screens, USB-C ports, and featuring an ergonomic design improving comfort on long flights.

The benefits of these new aircraft for passengers are substantial: cabins pressurized at a lower altitude, increased humidity, reduced noise, and larger windows significantly contribute to comfort on long-haul flights.

One of the most complex aspects of Air India's transformation concerns the onboard experience, which varies considerably depending on the aircraft and routes taken.

In the fall, Air India's long-haul experience presents three distinct realities.

On the new A350-900s (approximately 5% of the long-haul fleet):

On Boeing 787-9 Dreamliners inherited from Vistara (approximately 10% of the long-haul fleet):

On the rest of Air India's long-haul fleet – 777-200, 777-300ER, and 787-8 – (approximately 85% of the long-haul fleet):

This disparity creates an unpredictable experience for passengers. Taking the Delhi-London route as an example: depending on the day and scheduled aircraft, a Business Class passenger could either enjoy a modern closable suite with direct aisle access on an A350 or find themselves in an older 2-3-2 configuration on a 777.

"This is exactly what we call the 'lottery effect' in the industry. Air India's main challenge isn't creating an excellent experience on a few showcase aircraft, but raising the minimum standard across its entire fleet", explains Shashank Nigam, an aviation consultant.

On Indian domestic flights, the progressive integration of standards from Vistara has begun to transform the experience:

However, as with long-haul, the experience remains variable depending on the assigned aircraft. The older Air India A320s still offer a more basic experience than aircraft recovered from the Vistara fleet.

In September, the airline announced the renovation of cabins on 27 A320neos for a total cost of $400 million. This project aims to modernize the cabins of part of Air India's short/medium-haul fleet with cabins very similar to those found aboard Vistara's A320neos.

Air India's transformation also extends to all aspects of the ground experience.

Air India lounges, long criticized for their dated appearance and limited services, are undergoing a progressive renovation according to standards inspired by Vistara's Delhi lounges:

The first renovated lounges at Delhi Terminal 3 and Mumbai Terminal 2 provide a glimpse of this new direction, with spaces that combine contemporary aesthetics and Indian cultural touches.

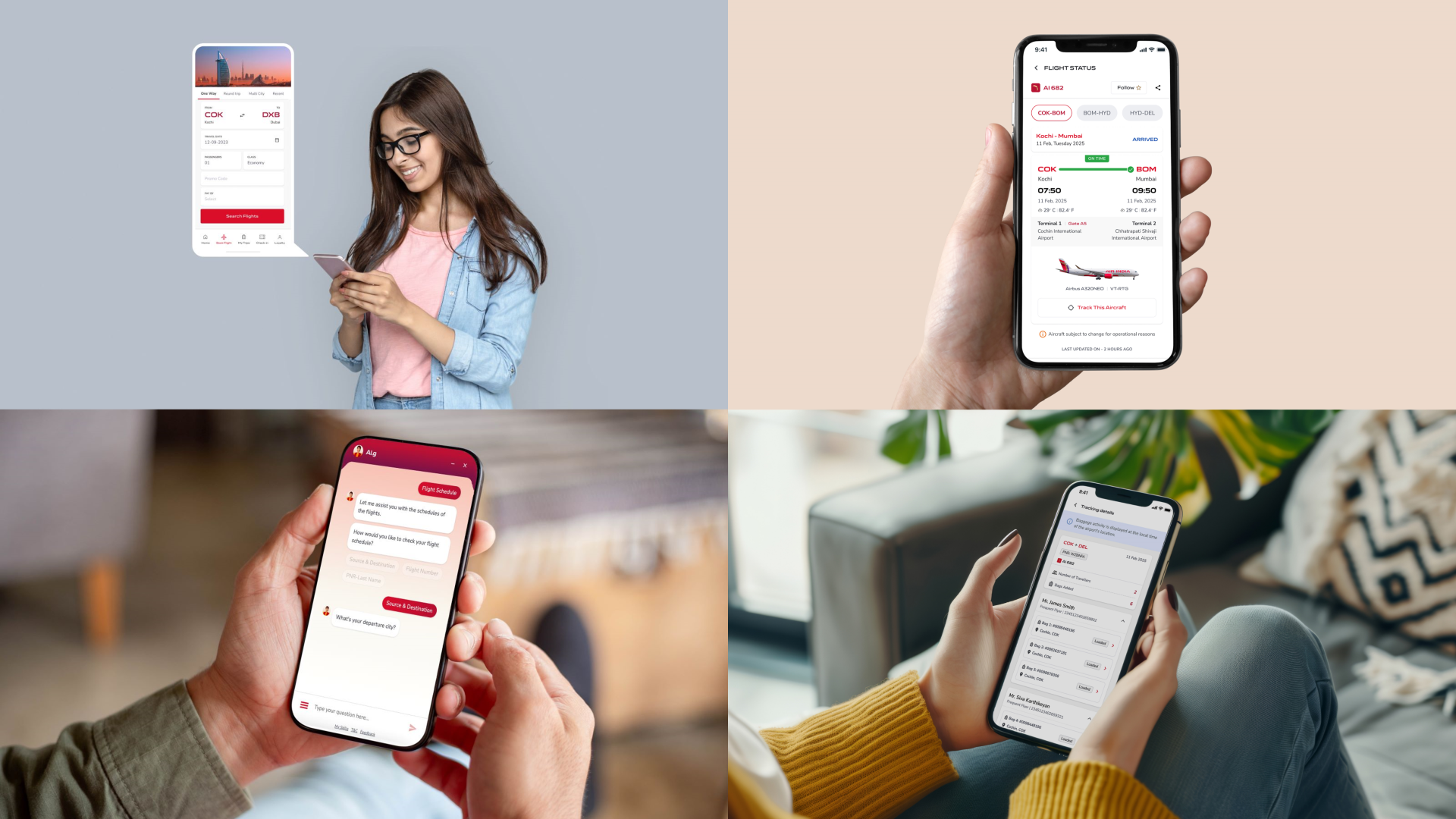

Vistara's digital expertise has been widely leveraged to modernize Air India's customer interface:

These improvements, although still being deployed, aim to bridge the considerable gap that existed between Air India and its competitors in terms of digital experience.

One of the most important aspects of the merger concerns the integration of Vistara teams and operational expertise into the new entity.

Former Vistara executives have played a predominant role in redesigning Air India's onboard service processes. Training manuals have been revised to incorporate Vistara service protocols, known for their attention to detail and more personalized approach.

This transfer is particularly evident in the following areas:

The Vistara fleet has been strategically reallocated to maximize its impact in the new entity:

This targeted allocation allows for offering a consistent premium experience on the most competitive and internationally visible routes, while preserving the investment made by Vistara in its high-end products.

Despite efforts and investments, the integration of Vistara into Air India reveals several challenges that directly affect the passenger experience.

Many travelers loyal to Vistara report a decrease in service consistency since the beginning of the transition. On the aviation forum FlyerTalk, a discussion thread dedicated to the merger records more than 200 testimonies documenting various issues:

Industry observers highlight the marked cultural differences between the two organizations as a major obstacle to the harmonization of the experience:

"The transformation of a corporate culture typically takes 3 to 5 years under normal conditions. In Air India's case, we're talking about transforming a 70-year-old organization by integrating elements from a much younger airline. It's a colossal challenge that goes well beyond the technical aspects of the merger", notes Harish Manwani, change management specialist.

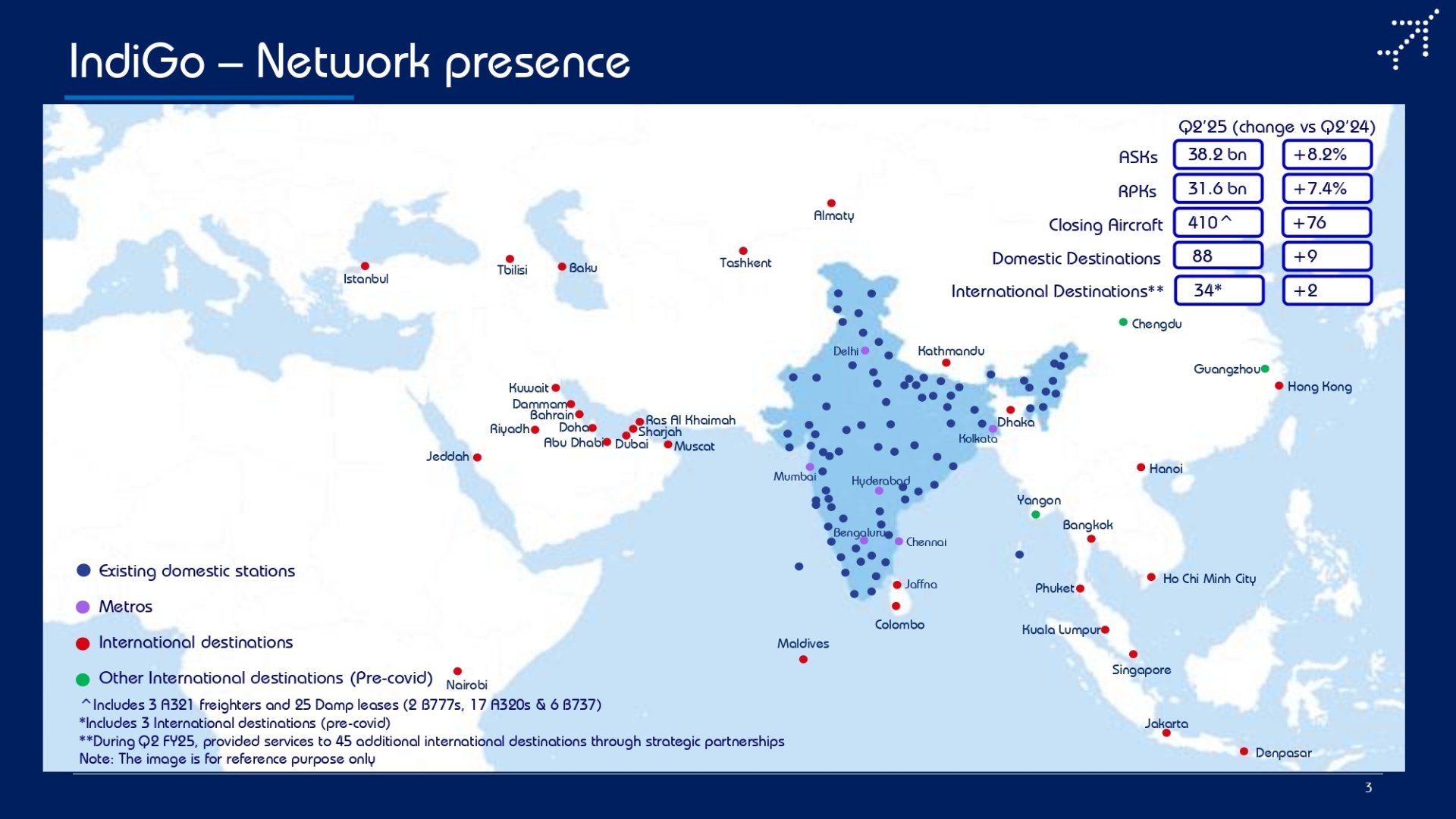

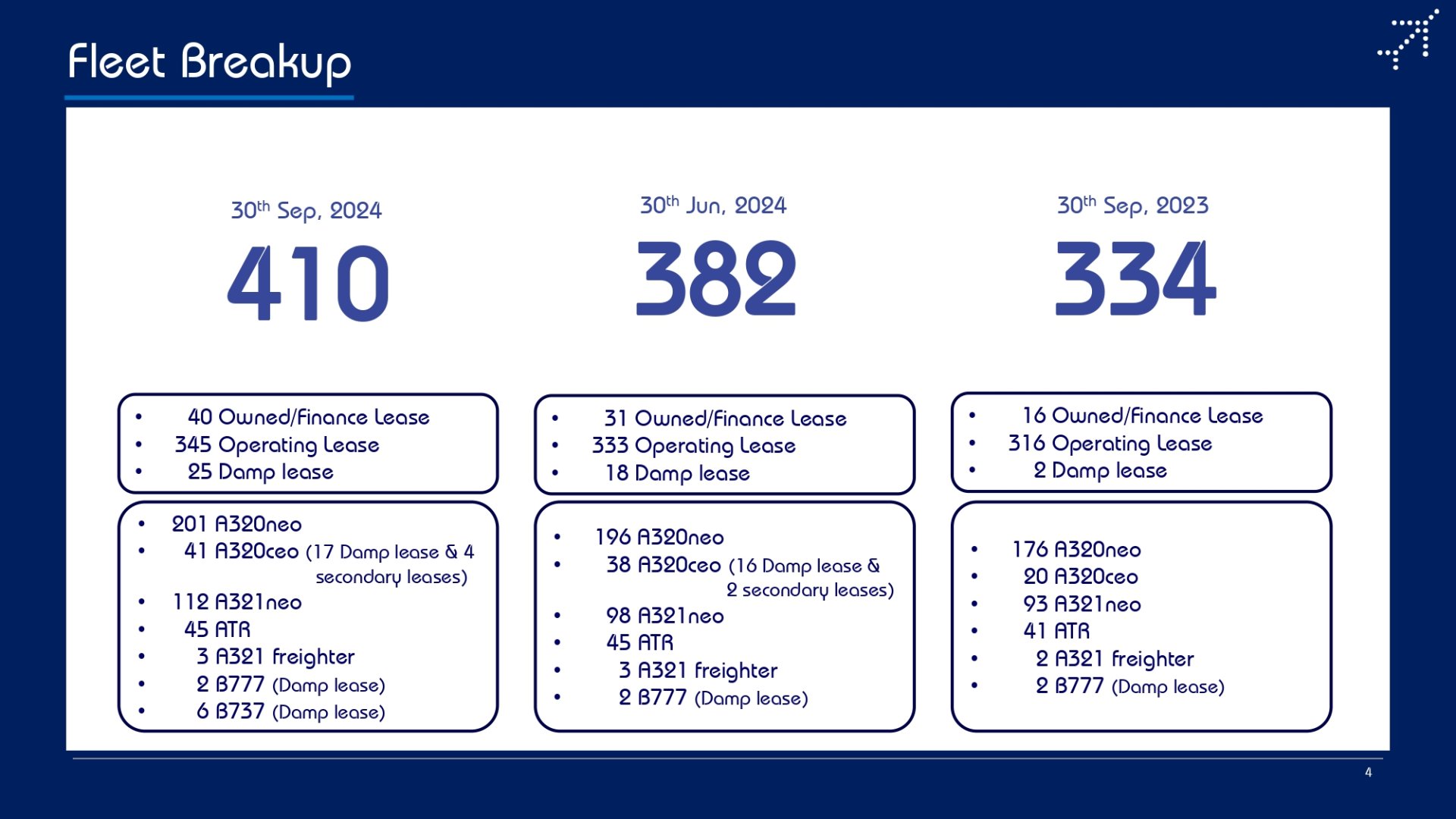

The merger of Air India and Vistara is taking place in an atypical Indian competitive environment, characterized by the overwhelming dominance of a low-cost carrier – IndiGo – which alone holds nearly 60% of the Indian domestic market.

With its fleet of over 350 aircraft and a domestic market share approaching 60%, IndiGo illustrates a rare phenomenon in global aviation: the dominance of a low-cost carrier over traditional operators. This situation can be explained by several factors:

Faced with this reality, post-merger Air India should not try to compete head-on with IndiGo in terms of volume or price, but rather establish a differentiated value proposition.

Its distinctive assets in the domestic market include:

However, Air India still has to overcome several disadvantages compared to IndiGo:

In the international segment, Air India's ambitions face formidable competition from Gulf carriers (Emirates, Qatar Airways, Etihad) and major Asian airlines (Singapore Airlines, Cathay Pacific).

The Indian carrier is attempting to develop a differentiated strategy articulated around several axes.

Against Gulf carriers:

Against Asian carriers:

One of the major obstacles to Air India's development as a top-tier global carrier lies in the limitations of Indian airport infrastructure.

Unlike the ultra-modern hubs of Dubai, Doha, or Singapore, India's main airports suffer from constraints that hinder the development of an efficient hub model:

"We recognize that developing an efficient hub is not limited to acquiring aircraft or improving cabins. It's a complete ecosystem that needs to be rethought, from schedules to airport infrastructure", affirms Campbell Wilson, CEO of Air India.

Improvements are underway, notably with the expansion of Delhi airport and the construction of the new Navi Mumbai airport, but their effects will not be fully felt until the medium term.

With just months before the definitive merger scheduled for March 2025, several questions remain regarding the future of the passenger experience on the new Air India.

Air India's transformation program, estimated at $400 million for cabin renovations alone, is undeniably ambitious. However, these investments, although significant, appear limited given the scale of the challenge: transforming a fleet that will reach more than 200 aircraft after the complete merger.

This reality imposes a progressive, phased approach, with the necessary prioritization of routes and aircraft. For passengers, this means that the "new Air India" experience will not be immediately available across the entire network.

Official plans suggest that:

Traveler reactions to this ongoing transformation oscillate between hope and skepticism.

On one hand, the travel community generally welcomes investments in the new fleet and visible modernization efforts. Initial feedback on the A350 experience and the former Vistara 787-9s has been largely positive.

On the other hand, Air India's complex legacy and current variations in service quality fuel persistent skepticism about the airline's ability to maintain high standards across its entire network.

"Air India must understand that earning premium passengers' trust takes years but can be lost in a single disappointing flight. Maintaining consistency in the customer experience will be the true test of this merger's success", notes Ajay Awtaney, founder of the specialized blog LiveFromALounge.

In the longer term, the Air India-Vistara merger could significantly reshape the competitive airline landscape in Asia.

For the first time in decades, India could see the emergence of an integrated carrier capable of competing with regional giants. With an immense domestic market as its base—the third largest in the world behind the United States and China—and an expanding international network, Air India possesses considerable strategic advantages.

The customer experience will be a determining factor in this equation. If Air India succeeds in capitalizing on Vistara's legacy while overcoming its historical challenges, it could develop a unique value proposition combining:

The Air India-Vistara merger represents far more than a simple consolidation of aviation assets. It symbolizes the meeting of two visions of the Indian aviation experience: Air India's historical heritage and global recognition on one hand, and Vistara's contemporary and premium approach on the other.

For passengers, this transition raises as many hopes as questions. While massive investments and initial visible results suggest a genuine commitment to transformation, the magnitude of the challenge remains considerable.

The passenger experience on the new Air India will likely continue to present significant disparities for several years, effectively creating a two-tiered system: a modern and competitive experience on priority routes and aircraft, and a more gradual transformation across the rest of the network.

In this context, discerning travelers would be well advised to remain attentive to the aircraft types operating their flights and the specifics of each route when booking with Air India in the months and years ahead. While the direction is clearly defined, the path toward a uniformly premium experience remains a long one to travel.

Featured image by Air India